Call Now for a Free Initial Consultation

Call Now for a Free Initial Consultation

In a previous article, we discussed how many people put off filing for bankruptcy until “forced” to do it. One of the common situations that forces the issue of bankruptcy is impending marriage. Waiting to file, as we will explain later in this article, is NOT the optimal solution for most people. In this article we will discuss some of the best reasons to take action today!

“Nothing is so painful to the human mind as a great and sudden change.” ― Frankenstein

“Hey Chris, what’s the longest you’ve seen someone put-off filing for bankruptcy?”

Chris: “The longest is probably 2 years before they came back to me and did the bankruptcy. In that time, they ended up paying 36k in unnecessary debts trying to keep afloat; ended up needing it anyways.”

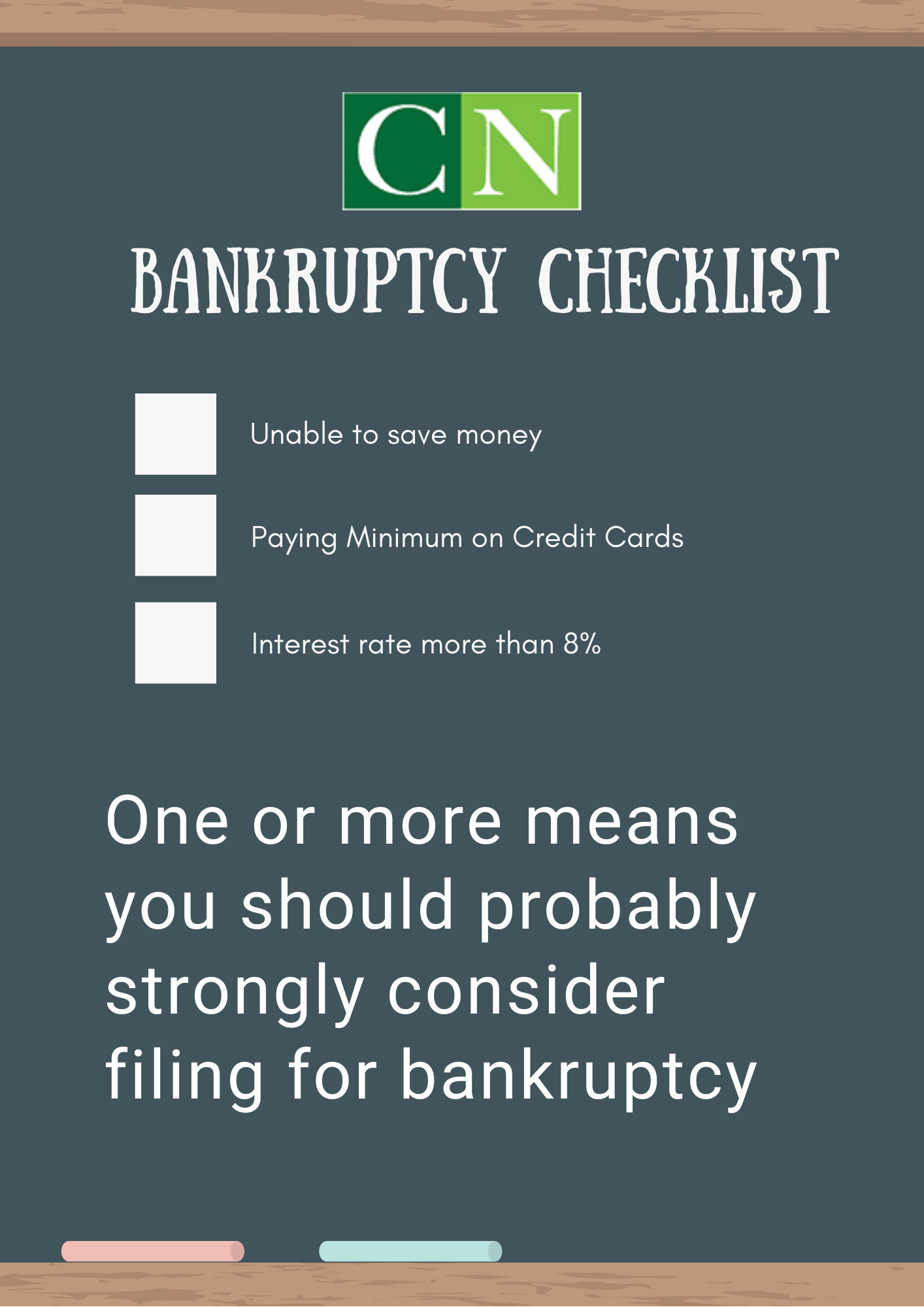

Is there a 1, 2, 3, checklist to ask yourself to get a quick sense of “is bankruptcy right for me”?

If you answered “yes” to 1 or more of the above, you may want to consider filing for bankruptcy. If you answered “yes” to all three, you are really flirting with disaster, and an unexpected event could put you in a really bad spot. You need a fresh start.

What are some of the mental obstacles to overcome when considering bankruptcy? Since we are located in Orange County, with a considerable Asian/Vietnamese population, and our lead attorney Chris Nguyen [link] is Vietnamese-American himself, we are acutely aware of some of these issues. In Asian communities especially, it can be viewed as taboo to even think about or consider bankruptcy. When money and status are admired traits (in all communities) — it can feel like a shameful thing to have to admit that you need to file for bankruptcy.

It must be noted that the process is as discreet as you want it to be. If you don’t want anyone to find out (outside of your creditors), just don’t tell anyone and they won’t be the wiser.

People feel they have failed at something. Failed at what though? Balancing a budget? Taking on the risks of a business? What have you learned? What can you fix if you get a clean start?

If people would talk more openly about their budgets they probably will find that many others within their own network are also struggling.

Mental health is beyond the scope of this article– but there are many similarities with the lack of discussing mental health and the lack of discussing budget balancing. It’s appropriate to consider here because a bad financial situation can negatively affect one’s mental health [read more: depression and bankruptcy].

They want to pay the money back.

File bankruptcy first. Then afterwards, you can give away money to your creditors (if you want to); they just can’t make you pay anymore.

Get rid of your obligation first. This is a legal remedy that is available to you. The same way as you would put a bandage on a wound– it is simply in your best interest to do so.

There is a huge misunderstanding in how the common person perceives the word “bankruptcy.” People generally do not understand that bankruptcy is just another financial tool. It is a release valve when the pressure of a financially distressing situation must be released. The problem is the negative connotation associated with the term “bankrupt.”

When you’re in debt– there’s a lot of metaphorical weight on one’s shoulders. Maybe you can relate. It can feel like real weight. It stays with you all day long and haunts you at night. It’s there when you wake up. All you can think about all day is how you don’t have enough money to pay that next credit card bill. Or maybe you’re already months behind and it’s gone to collections. You’re wondering “what’s next?” Starting the bankruptcy process can begin relieving your stress! And, depending on how long you take to get your own files together– we are fast at CN Law, and can potentially finish your bankruptcy filing within 30 days from the date we begin filing (contact us for specific info).

Before you file for bankruptcy, your creditors have a legal right to call you everyday, or as often as they wish, during reasonable business hours. Even if it’s “within reason,” any call from a creditor is one call too many! As if we didn’t have enough salespeople calling us with offers we don’t want. Even though creditors have a right to call, sometimes enough is enough and we just want it to stop. After we start the bankruptcy process, all correspondence will be handled by your attorney. That’s right– next time a creditor calls, just say “call my attorney” and give them our number (866-651-6118).

This is a serious matter that can not only affect your mental state, but your livelihood. Try not to let it get to this point. If there are legal judgments against you, especially from the government (think IRS), be very careful. A judgment will generally allow creditors to garnish your paycheck, among other things. Your employer will have no choice but to comply.

Similar to getting your paycheck garnished– a legal judgment against you from creditors allows them to literally deduct from your checking or savings account without notice or approval from you! Yup! If you didn’t know that, you don’t want to find out the hard way, like many of our clients.

Most people are not decisive with their actions. They try to make payments over time (average credit card interest rate is 14%). After 1 to 2 years, their debt balance has not decreased, they have built up no savings and are in the same place. If they file for bankruptcy, they can get an immediate fresh start.

Note that the act of filing for bankruptcy will negatively impact your credit score: payments to creditors will stop, and this will be reflected. In preparation for this, consider utilizing your credit score immediately before late payment reports begin to accrue on your credit report and lower your credit score (“credit worthiness”). Re-structure your assets to keep as much wealth as you can for yourself and then file bankruptcy for dischargeable debts.

Examples:

After filing for bankruptcy– lenders for home mortgages generally require a 2 to 4 year waiting period before you can qualify for a Mortgage Loan, depending on the type of loan (FHA, VA, Conventional). If you’re in a position to use your remaining assets to qualify and secure a home, it is best to do it prior to filing bankruptcy.

Hopefully you’re not tired of analogies yet because we’re going to give you another one. Even after reading this article, you could agree with everything here and still take no action. We see so many similarities with this (bankruptcy) and fitness. People know they should exercise, yet they don’t. People know they should avoid fast food and eat better, yet they don’t. People actually know how to exercise, yet they still don’t.

So what is it? It’s the motivation. It’s the status quo. It’s making change.

For some reason, we are all afraid of change– even if that change is good for you.

If you need help making that ‘good’ kind of change in your life, we are one call or chat away.

Contact Chris now for a free consultation.

p.s. If your situation is not severe enough to warrant filing for bankruptcy, you may want to look into debt consolidation [link to future debt consolidation article], which we can assist you with.

References:

https://www.experian.com/blogs/ask-experian/how-does-filing-bankruptcy-affect-your-credit/

Chris T. Nguyen is a native Californian; born and

raised in Southern California. Chris attended the

University of Southern California...Read More