Call Now for a Free Initial Consultation

Call Now for a Free Initial Consultation

[This article deals with getting sued in California only]

America has turned into a “sue happy” country with everyone threatening to sue one another for any number of legitimate or illegitimate matters. Most of these are empty threats and many of the ones that do get filed are frivolous. And while many people know the meaning of “I’m going to sue you,” far fewer people actually know what it entails, and whether it would be worth the time and resources to pursue. We’re here to set the record straight. In particular, we dive more deeply into the specific scenario of “getting sued” by one of your creditors.

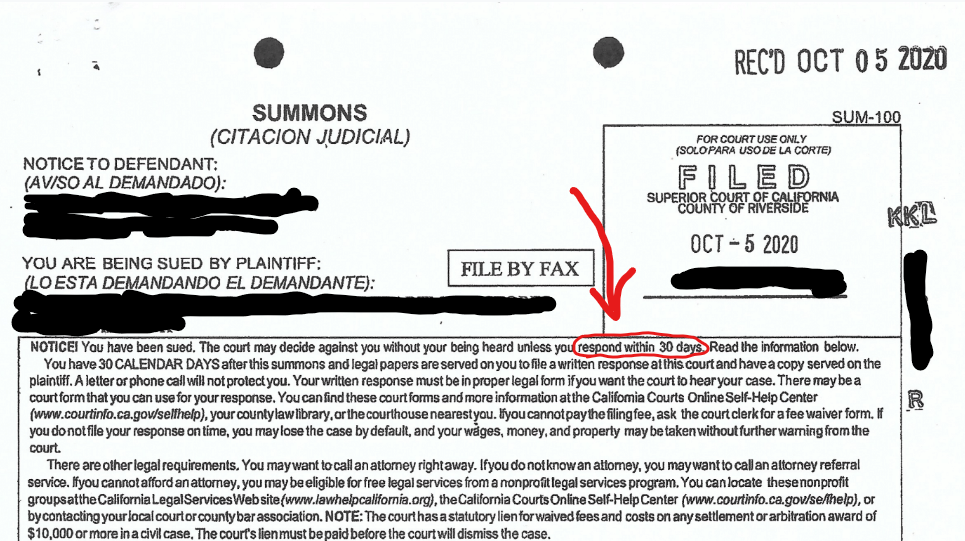

Let’s play defense first. Assume that you’ve been served with a lawsuit– what does it mean? Many people do not understand the legal process (in California, it varies from state to state) and this immediately places them at a disadvantage.

What constitutes ‘being served’ (with a lawsuit)?

Two ways get served

How much time do you have?

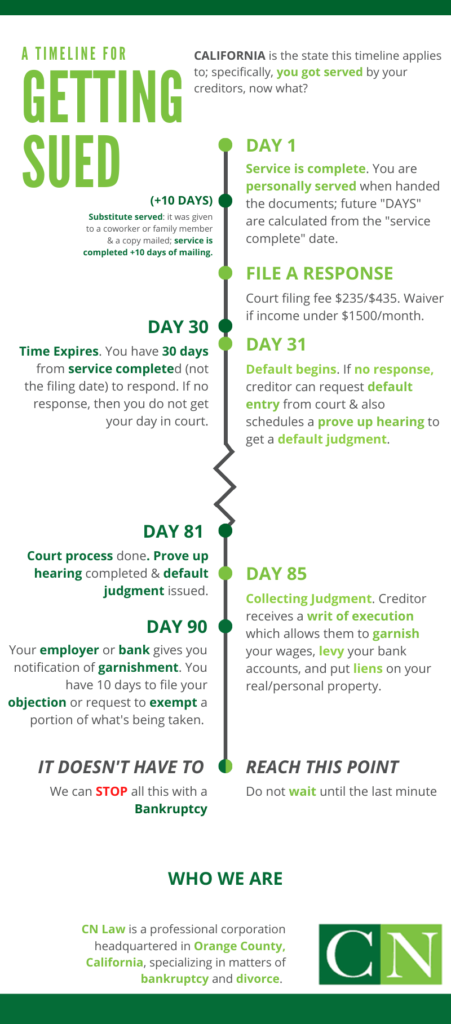

People commonly and incorrectly expect their initial paperwork to give them a trial date. That is not true. Trial is only set for when the case is ready for trial. What makes a case ready for trial? The defendant “appears” by filing a response that there are “issues” that are “ready” for the judge or jury to listen to and make a verdict. If you do not file a “response” and “appear” you do not have your day in court.

What is a response? Most people believe their response is the time for them to plead their case, as if the Court will then rule on what you said. That simply is NOT the process. So what is a response that you can file?

What is a “response”?

In most collection cases, you owe the debt. It is inevitable that you will lose the case and have a judgment against you. So how much time do you have?

If you do nothing:

It is important to note that at this point you have technically “lost” the case by not responding. Your creditor has won the lawsuit, gotten a judgment, and now has received a “writ of execution.”

It allows the judgment holder to:

How is a “writ of execution” used?

One option is to do nothing and let the creditors take your money leaving you unable to pay your bills.

OR

We can stop all this with a bankruptcy. It is prudent to begin the process with us now and make sure everything is set up. Do not wait until the last minute. Contact CN Law Now for a Free Consultation

References: www.courts.ca.gov

Chris T. Nguyen is a native Californian; born and

raised in Southern California. Chris attended the

University of Southern California...Read More