Call Now for a Free Initial Consultation

Call Now for a Free Initial Consultation

[infographic available for download at bottom of page]

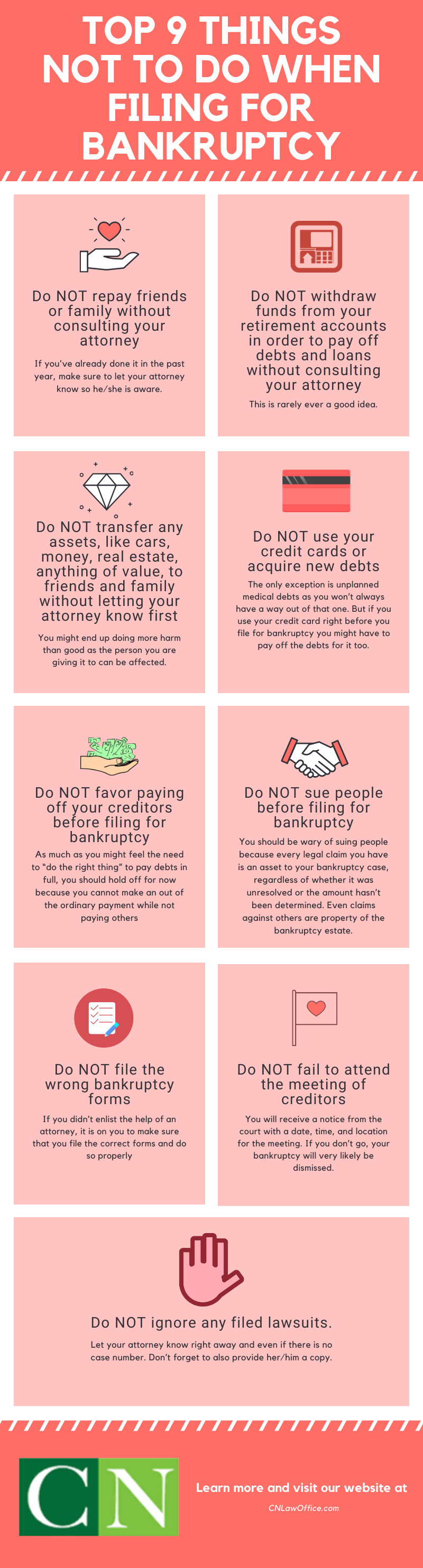

Filing for bankruptcy is an intimidating and challenging process (for most people). You might wonder how to even get started or what the first few steps are (read more: how to file bankruptcy on your own). While doing your research, keep in mind that there are as many things “NOT TO DO” as ones “TO DO”. As a guide, here are the major things you should NOT do before (and while) you file for bankruptcy.

If you’ve already done it in the past year, make sure to let your attorney know so he or she is aware. It might seem like you’re doing them a favor, but could actually be giving them more problems in the future while doing something fraudulent yourself. We’ll discuss “clawbacks” in more detail in #6.

This is rarely a good idea.

Example of when it CAN be a good idea?

Only in extraordinary circumstances, where your attorney can know all of your details could using your retirement be a good idea. For example, you have a car loan with a credit union for $10,000.00, but also a $5,000.00 credit card with the same credit union. You can’t keep your car loan without also keeping your credit card debt (Credit Unions are all or nothing). Essentially, you will be paying $15,000.00 to your credit union, to keep a car that’s probably not even worth the $10,000.00 car loan. However, if you’re able to pay off your car loan with your retirement, then you can discharge your $5,000.00 credit card – saving you $5,000.00 at the expense of using your retirement now.

Remember this is only a hypothetical simplified example of a super rare situation.

Though you might be able to do this, it requires certain requirements to be met or else you might end up doing more harm than good as the person you are giving it to can be affected.

The only exception is unplanned medical debts as you won’t always have a way out of that one. But if you use your credit card right before you file for bankruptcy you might have to pay off the debts for it too.

Let your attorney know right away and even if there is no case number. Don’t forget to also provide her/him a copy.

As much as you might feel the need to “do the right thing” to pay debts in full, you should hold off for now because you cannot make an out of the ordinary payment while not paying others. This can actually lead to something called a “clawback lawsuit” where the bankruptcy court trustee responsible for administering the case sues an entity or the person in order to get the money back in bankruptcy clawbacks of preferential and fraudulent transfers.

You should be wary of suing people because every legal claim you have is an asset to your bankruptcy case, regardless of whether it was unresolved or the amount hasn’t been determined. Even claims against others are property of the bankruptcy estate.

Filing for bankruptcy involves filling out a lot of different forms and other paperwork. There’s the petition, the schedules, the statement of financial affairs, along with other required documents. If you didn’t enlist the help of an attorney, it is on you to make sure that you file the correct forms and do so properly. Official bankruptcy forms can be obtained from the bankruptcy form page of the United States Courts website. You may also be required to fill out additional local forms as well. [see future article: how to file BK on your own]

Typically 20-to-40 days after filing your bankruptcy case, you have to attend a meeting called the 341 meeting of creditors. This is where the bankruptcy trustee and any creditors who choose to participate can ask you questions under oath about your bankruptcy and financial affairs. You will receive a notice from the court with a date, time, and location for the meeting. If you don’t go, your bankruptcy will very likely be dismissed.

As a rule of thumb, always consult your attorney if you are unsure whether to do something or not. There is a lot of work to be done in order to prepare for your bankruptcy filing. Consulting the right people and not making rash choices on your own will help in making the process go smoothly.

Need help deciding if you can qualify for bankruptcy in the first place? Please contact us.

Otherwise, this article [insert link for do it yourself bankruptcy] can guide you through the necessary steps if you decide to go at it on your own.

Chris T. Nguyen is a native Californian; born and

raised in Southern California. Chris attended the

University of Southern California...Read More