Call Now for a Free Initial Consultation

Call Now for a Free Initial Consultation

As a bankruptcy law firm (in Orange County, California), some of our clients approach us already knowing the benefits of filing for bankruptcy. Others are completely unaware of what the bankruptcy process entails. A few aren’t even sure if they qualify for bankruptcy in the first place.

It’s also common to have preconceived notions of what bankruptcy is, or is not.

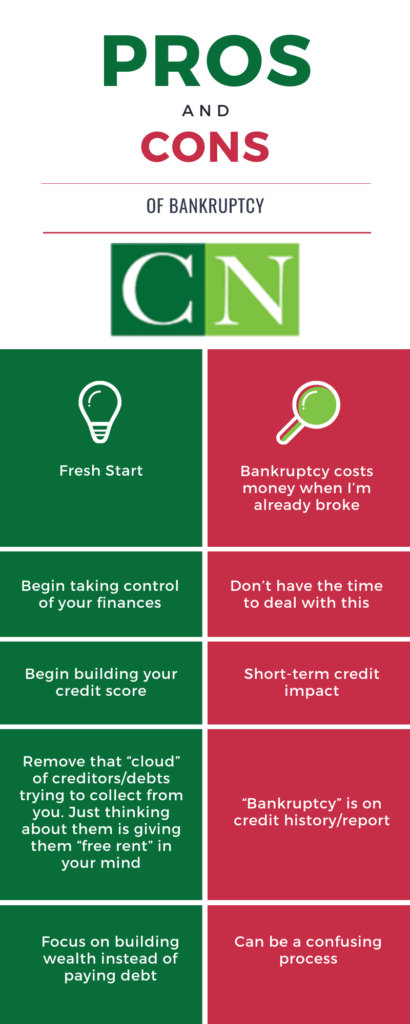

In an effort to remain informative, we attempt to tackle any real or perceived ‘negatives’ (in regards to filing for bankruptcy) in today’s article.

Let’s get the bad news out of the way first.

The act of filing for bankruptcy itself implies a negative financial situation. It begs the question, “how is someone who is claiming to be broke supposed to hire an attorney?”

Bankruptcy Attorney Response:

It does seem counterintuitive that you have to spend money when you don’t have money. There are two types of people:

The many steps and forms involved seems like a daunting process. With work and other family obligations, how does one find the time to gather documents and attend court meetings?

Bankruptcy Attorney Response:

The process is made to be smooth at our office. We offer numerous ways to be flexible and obtain the information we need to prepare the documents on your behalf and answer any questions you have. We make sure that you feel like you’re in the right hands so you can better focus your time elsewhere.

In bankruptcy, the debtor stops making payments on debts, thus creating a negative impact on credit score.

Bankruptcy Attorney Response:

Long-term credit impact is of course the goal. While you may not see it now, by clearing your high interest debts, readjusting your budget and your means, your savings will capitalize exponentially in terms of less spent on financing charges (interest).

The “bankruptcy” notch becomes a permanent mark on one’s record which future lenders will use to judge creditworthiness.

Bankruptcy Attorney Response:

So is every monthly late payment. A credit report is not “static” but always changing and updating as time passes. A credit report can provide information for the last 7 years. Would you rather have 3 years of late payments reported or file bankruptcy now, and then see only positive remarks following it?

It can be embarrassing both professionally and culturally to admit financial difficulty.

Bankruptcy Attorney Response:

While bankruptcy is a public record, unless someone purposefully goes searching for it, they wouldn’t otherwise know about it unless you informed them.

Below is a brief summary of the benefits gained after filing for bankruptcy. Read this article for more reasons to file now.

For a FREE Consultation

Contact us and an attorney will help you weigh the pros and cons. At the very minimum we can advise you if you qualify and what the costs are during your free consultation.

Chris T. Nguyen is a native Californian; born and

raised in Southern California. Chris attended the

University of Southern California...Read More